When embarking on an entrepreneurial journey, one of the biggest challenges is securing funding. Cold emailing investors can be a strategic move for startups looking to attract potential funding. With the right approach, these emails can open doors to valuable conversations and, ultimately, investment opportunities. Understanding how to effectively communicate with potential investors through cold emails is therefore a vital skill for any founder.

In this guide, we’ll walk you through the essential components of a cold email crafted to catch the eye of an investor. From building your investor email list to crafting personalized content that resonates, this comprehensive guide will help you navigate the intricacies of cold outreach with confidence.

TL;DR

- Cold emails are essential for startups looking beyond their network to engage potential investors and create new opportunities.

- Building a curated investor email list aligned with your startup’s sector and values is paramount for effective outreach.

- Crafting the perfect cold email involves a blend of professionalism and personal touch, with a concise and compelling subject line vital to grabbing attention.

- Personalization and relevance in the email content can significantly increase the chances of catching an investor’s interest.

- The opening of the email should hook the investor and succinctly introduce the startup and its vision.

- Describing the problem your startup solves and how it does so can intrigue investors who are naturally inclined towards problem-solving opportunities.

- Providing evidence of your startup’s value and growth potential is critical to persuading investors of the potential for high returns.

- A compelling call to action (CTA) in the email encourages investors to engage further with your proposal.

- Including a detailed pitch deck can offer investors deeper insights into your startup’s business plan and potential.

- Bullet points enhance clarity and organization in the email, making key points more digestible.

- Using psychological techniques can boost responses, while understanding the technical aspects, like SPF and DKIM records, ensures email deliverability.

- Researching potential investors and tailoring the email to their investment history and preferences increases the likelihood of success.

- Professionalism and credibility are non-negotiable. Emails must reflect seriousness and dedication to the business.

- Persistent, non-intrusive follow-up strategies are essential for standing out from other entrepreneurs.

- Handling rejections with professionalism can provide valuable feedback and improve future outreach strategies.

- Avoiding common pitfalls like failing to follow-up, sending generic emails, or not demonstrating potential investment returns is crucial.

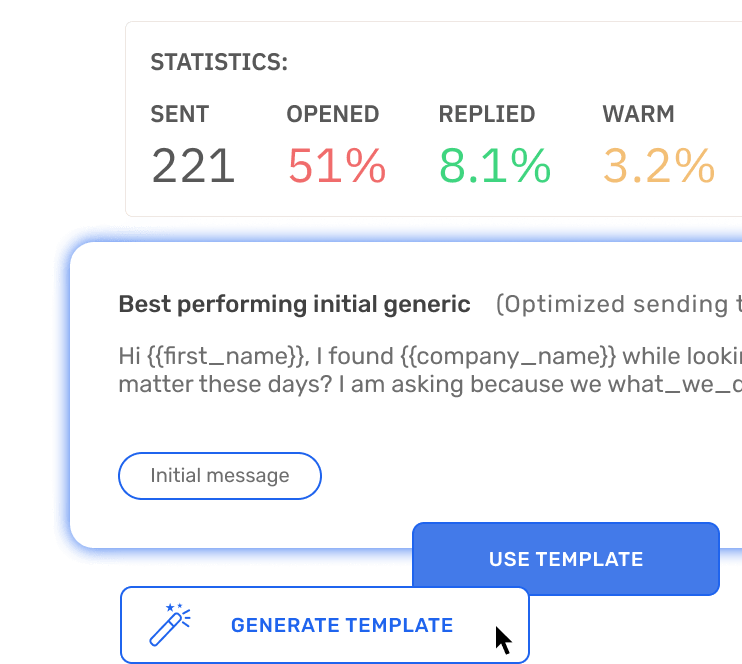

- Tracking results and continuously optimizing the cold emailing strategy is key to securing investment.

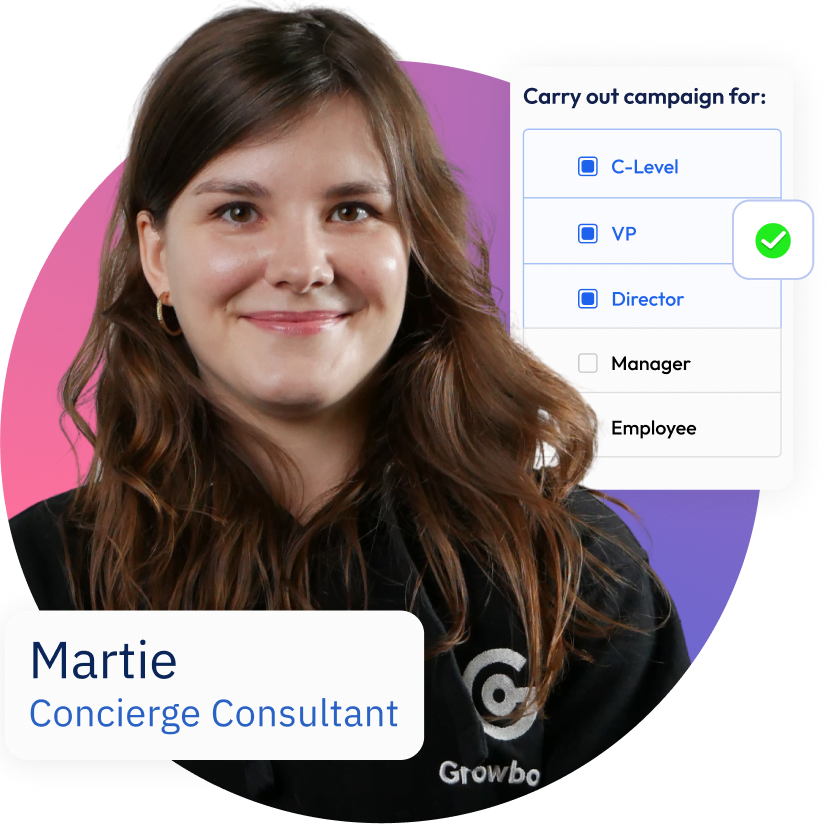

- To streamline your cold emailing process and maximize your chances of securing investor funding, sign up for a Growbots trial. Benefit from our automated platform that offers personalization at scale, ensures your emails hit the mark, and provides valuable insights to continually refine your outreach strategy.

Reach More with Less Effort

Connect with Potential Clients at scale

- AI message generator

- E-mail verification

- Multichannel sequences

- A/B testing

Understanding the Importance of Cold Emails

Cold emails are more than just a means to an end; they are a crucial part of an overall strategy for startups seeking to make powerful connections with the right people. Unlike warm networking, cold emailing allows you to reach investors outside your immediate circle, potentially leading to fresh opportunities. As such, understanding the significance of cold outreach is the first step to creating an email that investors will want to read.

Cold B2B emails have an average open rate of 24%, emphasizing the significance of crafting compelling subject lines to draw the recipient’s attention

Source: pipelinezen.com

Why not see how cold emails fit into a larger marketing strategy? Learn more about it in our detailed article on Cold Email Marketing.

Building Your Investor Email List

Before crafting your email, you need to know whom you’re addressing. Building a list of potential investors requires thorough research and strategic selection. Consider investors who have a history of betting on companies in your sector and those aligned with your startup’s vision and values. Proper list segmentation ensures that your cold emails are reaching the most suitable prospects.

| Source | Method | Notes |

| Networking & Direct Search | Use keywords and filters | |

| AngelList | Startup & Investor Profiles | Look for industry preferences |

| Industry Events | Attend & Network | Collect business cards and contact information |

| Databases | Use Investor Databases | Access to vetted investor contacts |

Crafting the Perfect Cold Email

The art of crafting the perfect cold email lies in striking a balance between professionalism and personal touch. Start with a clear and compelling subject line—this is your first and possibly only chance to make an impression. The content of your email should be concise, highlighting the most intriguing aspects of your business proposal.

| Component | Description |

| Subject Line | A compelling teaser of the email’s intent |

| Introduction | Briefly introduce the startup |

| Value Proposition | State what sets the startup apart |

| Investment Invitation | Encourage engagement or a meeting |

Personalization and Relevance

Personalization is the key to making your cold email stand out. Addressing your recipient by name and demonstrating that you’ve done your homework on their investment style will show that you’re serious about your request. Relevance, too, cannot be understated; your email should resonate with the specific interests of the investor.

Personalized emails are shown to be opened 4%-5% more than generic ones, emphasizing the importance of addressing the recipient directly and referencing their achievements or interests

Source: smartlead.ai

| Tips for Personalization | Why It’s Effective |

| Reference past investments | Shows alignment with interest |

| Cite recent articles or talks | Demonstrates research |

| Tailor value proposition | Indicates thoughtfulness and strategy |

Learn about the effectiveness of personalized content in our guide on Effective Call to Action in Emails.

The Opening: Introducing Yourself and Your Startup

Your opening sentence needs to hook the investor immediately. Introduce yourself and your startup succinctly, paving the way for a deeper conversation. Demonstrate that you’re not just looking for any investor; you’re looking for a partner who shares your vision and can contribute to your startup’s growth.

| Opening Element | Function | Note |

| Your credentials | Establish legitimacy | Highlight relevant experience |

| Startup’s vision | Show purpose | Convey the bigger picture |

| Unique offering | Emphasize uniqueness | Clearly state USP |

For insights on perfecting the initial pitch to investors, check our extensive resources on Sales Prospecting.

Emails with a consistent theme between the content and the landing page can boost conversion rates by up to 50%, emphasizing the need for a coherent message in the email opening

Source: pipelinezen.com

Describing the Problem and Your Solution

Investors are problem-solvers by nature and are always on the lookout for businesses that bring innovative solutions to the table. In your cold email, concisely describe the problem you’ve identified and how your startup addresses it. A clear explanation of your solution’s unique value proposition can pique the interest of potential investors.

Emphasize your startup’s strong aspects by learning from our article on 17 Reasons Your Outbound Emails Go to Spam and How to Fix It.

| Problem-Solution Dynamics | Importance |

| Clearly Defined Problem | Establishes need for the solution |

| Differentiated Solution | Highlights how the startup stands out |

| Evidence of Validation | Demonstrates market fit and potential |

Showcasing Your Startup’s Value and Potential

Every investor is looking for potential unicorns – startups that promise high returns. When emailing investors, be prepared to showcase evidence of your startup’s value and growth potential. Mention any existing traction, such as customer testimonials or revenue, to build credibility.

Seek, pick, and reach

Connect with your potential customers

- 180m+ contacts

- Advanced filtering

- Multichannel sequences

- CRM integrations

Need tips on how best to present your startup’s growth potential? Get inspired with our insights from The Essential Guide to Sales Engagement Platforms.

| Value Highlights | Description |

| Market Size & Potential | Market research data and projections |

| Traction | User growth, revenue numbers, or other KPIs |

| Competitive Advantages | Unique technology or strategic partnerships |

The Importance of a Strong Call to Action (CTA)

A compelling call to action can make the difference between an opened email and a partnership. A targeted CTA encourages the reader to take the next step, whether it’s replying to your email or scheduling a call to discuss further. It should be clear, concise, and easy to act upon.

Discover the intricacies of a persuasive call to action with examples in our guide on Killer Email Campaign First Message.

| Effective CTAs | Function |

| “Schedule a Call” | Direct and time-sensitive |

| “View Our Pitch Deck” | Provides more detailed information |

| “Reply with Your Interest” | Encourages a conversation |

If you want to get to know ins and outs about creating the best call to action, read our article: How to Write an Effective Call to Action in Emails.

Attachment of Pitch Deck

Attaching a well-prepared pitch deck to your cold email can provide investors with a detailed insight into your startup. It should cover key points of your business plan and forecast, clearly explain what you need the investment for, and show how you plan to generate a return on investment.

| Pitch Deck Essentials | Details |

| Business Model | Outline how the startup will make money |

| Market Analysis | Include data and trends to back market potential |

| Team Overview | Highlight the expertise and experience of key team members |

Understand more about perfecting and including a pitch deck in your cold email through our discussion on Create Better Sales Pitch Decks.

Email Content: Dos and Don’ts

In the body of your cold email, clarity and relevance take precedence. Always cater your content to the individual investor, highlighting what you know about their portfolio and interests. Avoid using buzzwords or jargon that can dilute the message, and keep things as specific as possible.

Dos:

- Be brief and to the point.

- Utilize white space for clarity.

- Use a professional yet conversational tone.

- Prove credibility with evidence of traction or endorsements.

- Provide a clear CTA.

Don’ts:

- Don’t use excessive industry jargon.

- Avoid long paragraphs.

- Don’t forget to proofread.

- Avoid hyperbole and unrealistic claims.

- Don’t be too pushy.

For vital insights into crafting outstanding email content, check out our article on Avoid Email Spam Filters with Outreach Emails.

Use of Bullet Points for Clarity

Bullet points are an effective way to present complex information in a digestible format. Coming across as organized and clear, they can enhance the readability of your email, ensuring that the key points stand out.

Bullet points advantages:

- Improved clarity

- Better organization

- Highlight key facts

For advice on structuring effective bullet points, refer to our insights regarding Outbound Sales: The Ultimate Guide.

Psychological Techniques to Enhance Responses

Incorporating elements of psychology into your cold email can greatly increase your chances of receiving a response. Use principles of persuasion, such as the scarcity principle or social proof, to make your proposal more appealing. Also, consider the timing of your email, as it can have a significant impact on open rates.

Emails that address the recipient’s recent achievements or shared interests can foster a sense of personal connection, potentially doubling response rates.

Source: smartlead.ai

Timing techniques and their impact on email engagement can be explored in our guide on When Is the Best Time to Send Cold Emails.

| Psychological Technique | Application | Impact |

| Reciprocity | Offer valuable information upfront | Encourages a response |

| Social Proof | Name-drop interested parties | Validates the startup’s potential |

| Authority | Highlight endorsements and credentials | Establishes credibility |

| Scarcity | Indicate a limited investment opportunity | Urges investors to act quickly |

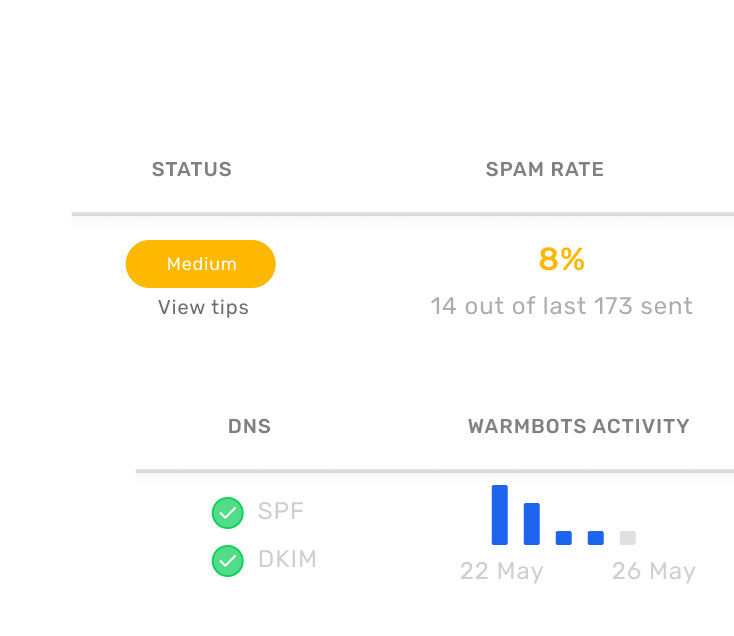

Technical Aspects: SPF and DKIM Records

The technical side of emailing is often overlooked but is crucial for ensuring your message lands in the right inbox. Setting up SPF and DKIM records helps authenticate your email, thus preventing it from being flagged as spam.

Warm-Up for Predictable Outcomes

Reach Inboxes, Not Spam Folders

- NO Cost for 3 Inboxes

- Monitoring

- For all email providers

- Deliverability Testing

your email setup check

Be compliant with the newest Google & Yahoo regulations

- SPF Record CHECk & setup

- DKIM Record Check & Setup

- DMARC Policy Setup

- Creating a new custom domain

For an in-depth look at these technical considerations, please review our article on What Is Email Deliverability?.

| Technical Aspect | Purpose | Impact on Cold Emailing |

| SPF Record | Authorizes sending servers for your domain | Prevents emails from being marked as spam |

| DKIM Record | Adds a digital signature for authentication | Enhances trust in the legitimacy of the email |

Researching Potential Investors

Gathering information about your potential investors can improve the success rate of your cold emails. Understand their investmnt history, preferred communication styles, and the types of startups they are interested in. Tailor your email to these specifics to make your pitch more effective.

leave no lead unexplored

Every potential client within reach

- 180m+ contacts

- CRM integrations

- 23 Prospect filters

- 15 Company filters

Start research with our insights on 6 Secrets to Successful Sales Prospecting.

| Research Components | Why It Matters |

| Investment History | Indicates preferences and patterns |

| Focus Areas | Helps tailor the pitch to their interests |

| Recent Deals | Shows current market activity and trends |

The Role of Professionalism and Credibility

Establishing a sense of professionalism and credibility in your cold email is non-negotiable. Use professional language, offer clear evidence of your startup’s potential, and maintain a tone that reflects your sincerity and dedication to your business.

Tips on how to project professionalism and credibility through your emails can be further explored in our content on Cold Email vs Cold Call.

| Professionalism/Credibility Element | Description |

| Grammar and Spelling | Ensure error-free content |

| Layout and Formatting | Keep the email clean and skimmable |

| Business Metrics | Include key figures to support the narrative |

| Press Coverage/Testimonials | Highlight third-party validation |

Follow-Up Strategies

Persistence in follow-up can set you apart from others. Without being intrusive, gently remind investors about your initial contact and express your continued interest in discussing your proposal further. A well-timed follow-up can be just as crucial as the cold email itself.

Sending the first follow-up within 2 to 5 days after the initial email can increase reply rates by up to 31%.

Belkins.io

Discover how to create an impactful follow-up strategy with our guide on Email Follow-Up Strategy That Works.

| Follow-Up Interval | Suggested Action |

| 1 Week | Gently remind of the initial communication |

| 2 Weeks | Provide additional information or update |

| 1 Month | Offer a last chance to talk before moving on |

Handling Rejections and Feedback

Rejection is part of the cold emailing process, but how you handle it is essential. Take any feedback provided seriously, and see rejections as opportunities to improve your approach. Stay respectful and professional in all communications, and use feedback to refine your strategy for future outreach.

Learn from our insights on Challenges Faced by Sales Development Reps to better handle rejection and feedback.

| Response to Rejection | Importance |

| Gratitude | Maintains professionalism and courtesy |

| Openness | Leaves possibility for future interaction |

| Incorporation of Feedback | Allows for continuous improvement |

Common Pitfalls in Cold Emailing Investors

Several common pitfalls can derail your efforts when cold emailing investors. These include failing to follow-up, sending generic emails, or forgetting to show how their investment could generate returns. Avoiding these mistakes is crucial for a successful investment acquisition strategy.

For more details on what to avoid, check our guidelines on Why People Ignore Your Cold Sales Emails.

Conclusion

Securing investment through cold emails requires a mix of persuasion, preparation, and perseverance. By providing a personalized and relevant email that resonates with the investor’s interests and demonstrates your startup’s potential, you stand a better chance of receiving positive responses. Remember to track your results and continuously optimize your approach for the best outcomes.